So you’ve managed to save $500,000 (or €500,000, or £500,000—let’s keep it simple and talk in dollars, even if I’m Italian and I think in euros most of the time). The question that’s probably in your head right now: can you finally leave that toxic job, those annoying coworkers, and live from this money?

The short answer is: maybe, but it depends. And I mean, it really depends. The long answer is about tax codes that will make you want to cry, withdrawal rates that change depending on where you live, and a lot of “well, it depends…” situations. Let me explain, but I’m warning you—this gets complicated, especially if you’re Italian like me.

The 4% Rule

Usually when people talk about FIRE, they start with the 4% rule. The idea is simple: if you take out 4% of your portfolio in the first year of retirement, and then you adjust that number for inflation every year, you have a good chance of not running out of money in 30 years. This rule comes from something called the Trinity Study, which tested U.S. stocks and bonds from 1926-1995. (Notice how it’s all about U.S. data? Yeah, this will be important later.)

With $500,000, if you take 4% out, that’s $20,000 per year (or around $1,667 per month). Sounds pretty good, no? Like, you could live with that if you’re careful with money.

But here’s the thing that nobody tells you when you read those happy FIRE blogs: that $20,000 is before taxes. And depending where you live, how you’ve set up your investments, and what kind of assets you’re selling, the tax situation can be really different. Like, really different. We’re talking about the difference between “I can almost buy a nice coffee every morning” and “I can buy a coffee every morning” here.

What Should You Actually Invest In?

Before we dive into the tax nightmare, let me talk about what I usually suggest people invest in: VWRL (Vanguard FTSE All-World UCITS ETF).

VWRL is basically a globally diversified ETF that tracks the FTSE All-World Index. This means it invests in large and mid-cap stocks from developed and emerging markets all around the world—think US, Europe, Japan, China, and basically everywhere else. It’s a passive index fund, which means it just follows the market instead of trying to beat it. This is what I usually recommend because:

- It’s simple: One ETF, global diversification, done.

- It’s cheap: The expense ratio is really low (around 0.22%), which means more money stays in your pocket.

- It’s broad: You’re not betting on one country or sector—you’re betting on the whole world economy growing.

The returns: Since VWRL started in 2012, it has delivered an average annual return of around 12.76% (nominal). But for FIRE calculations, we usually think about real returns (after inflation). Historically, global stock markets have returned around 7-8% nominal, which after inflation (typically 2-3%) gives us about 5-6% real returns per year. This is what I use in my calculations—6% real returns for long-term projections.

So when I say “if we assume 6% real returns” in this post, that’s based on VWRL and similar global index funds. Your $500k, if invested in VWRL and left alone for 30 years, would grow to about €2.4M in today’s money (adjusted for inflation). But of course, you’re not leaving it alone—you’re taking money out every year, which is where the math gets tricky, especially with Italian taxes.

Scenario 1: Italy — Where Your Dreams Go to Die

Let’s start with Italy, because this is where I live and where the tax situation is really bad for investors. I’m not joking here. When I first understood how the Italian tax system works for investments, I really thought about moving to another country. (I didn’t do it, but I thought about it a lot.)

The Italian Tax Situation

In Italy, most of what you earn from investments is taxed at 26%. Let me say that again: twenty-six percent. It doesn’t matter what you invest in:

- Capital gains from stocks, ETFs, bonds: 26% (because why not?)

- Dividends: 26% (the government wants its part)

- Interest from bonds: 26% (no exceptions)

- Cryptocurrency gains: 14% if you keep it for more than 365 days (the only “discount” we get), 26% otherwise

There’s a small thing that makes me laugh: the first €1,500 of capital gains per year is tax-free. That’s like getting a free coffee when you’re trying to buy a house. It’s technically a discount, but when you’re trying to live from $500k, it’s basically nothing. Thanks, but no thanks.

The Math

Okay, let’s do the math. If you need $20,000 per year after taxes, you need to take out:

- $20,000 ÷ 0.74 = $27,027 per year (because the government takes 26% of what you make)

- This is a 5.4% withdrawal rate, not 4%

That’s dangerous. The 4% rule already means you’re taking some risk. Going to 5.4% because of taxes makes it much more likely you’ll run out of money, especially if you’re retiring early (30+ years ahead). It’s like driving 160 km/h on the autostrada when the limit is 130—you might be okay, but you’re definitely taking more risk than you should.

Conservative Italian Scenario

If you want to stick to a 4% withdrawal rate after taxes (which is probably what you want):

- $500,000 × 4% = $20,000 per year

- $20,000 ÷ 0.74 = $27,027 gross withdrawal (because of taxes)

- Effective withdrawal rate: 5.4%

This is risky for a retirement of 30+ years. Like, “I might run out of money before I die” kind of risky. You’d probably want to aim for a 3% withdrawal rate to be safer:

- $500,000 × 3% = $15,000 per year after tax

- $15,000 ÷ 0.74 = $20,270 gross withdrawal

- Effective withdrawal rate: 4.05%

So in Italy, $500k gives you about €13,500-15,000 per year (€1,125-1,250/month) in safe spending money. That’s barely above Italy’s poverty line and definitely in Lean FIRE territory. If you don’t know what Lean FIRE is, I wrote about the different types of FIRE strategies in a previous post. Short version: you’re going to live very simply. Very, very simply.

Italian Tax Optimization Strategies

There are a few ways Italians can try to reduce taxes, but honestly, they’re not great:

- PIR (Piani Individuali di Risparmio) — If you keep investments in a PIR account for at least 5 years, you get some tax benefits. But the rules are complicated, and you’re stuck. It’s like signing a contract with the devil, but the devil is the Italian tax system.

- Life Insurance Investment Products — Some polizze assicurative have lower tax rates (around 12.5% instead of 26%), but they have high fees that usually cancel out the benefit. It’s like getting a discount on a Ferrari, but then you find out you have to pay for parking in central Milan every day.

- Real Estate — If you own rental properties, the tax situation is different (and usually better), but that’s a completely different thing. You’re not just investing anymore—you’re becoming a landlord, which has its own problems.

For most people who just invest in passive index funds like VWRL in Italy, the 26% tax is unavoidable. It’s like death and taxes, but in Italy, taxes are definitely more certain. Even though VWRL has delivered good returns (around 12.76% average since 2012), you still lose 26% of those gains to taxes when you sell. So that 12.76% becomes more like 9.4% after taxes—still decent, but not as exciting.

Quick Reality Check: USA & UK

Just to give you some context: if you’re American, you have Roth IRAs (tax-free withdrawals forever) and 0% capital gains tax brackets. If you’re British, you have ISAs (also tax-free forever). Basically, they can use the 4% rule more or less as it was meant to be used. With $500k, they’re looking at roughly $15,000-20,000 per year after taxes, which is still Lean FIRE but more manageable than the Italian tax situation.

Now, back to the real world where most of us live…

The Real Question: Can You Live on $15,000-20,000 Per Year?

Let’s be honest: $15,000-20,000 per year (€13,500-18,000 or £12,000-16,000) is not a lot of money, especially if you’re:

- Living in a major city (Milan, London, New York, etc.)

- Paying rent or a mortgage

- Supporting a family

- Wanting to travel or pursue hobbies

This is Lean FIRE territory. You’re trading comfort for freedom. If you want to understand more about different FIRE types and strategies, check out my previous post.

What $500k Can Actually Support

For Italy specifically, here’s what you’re looking at:

| Withdrawal Rate | Gross Withdrawal | After 26% Tax | Monthly | Risk Level |

|---|---|---|---|---|

| 3% (safe) | €20,270 | €15,000 | €1,250 | Medium |

| 4% (risky) | €27,027 | €20,000 | €1,667 | High |

For Americans and Brits: you’re looking at roughly $15,000-20,000 per year after taxes, depending on your account structure. Still Lean FIRE, but more manageable than Italy.

Making $500k Work: Your “Almost FIRE” Playbook

Okay, so $500k isn’t enough for full FIRE in Italy, but that doesn’t mean you’re stuck working until you’re 70. Here’s how to make it work for an “almost FIRE” situation—where you have enough financial freedom to really change your life, even if you’re not fully retired.

1. Geographic Arbitrage

If you’re serious about making $500k work, think about moving somewhere cheaper. I’m talking about:

- Small towns in Italy: Rent in a small town in Puglia or Sicily is easily half of what you’d pay in Milan or Rome. €1,200/month can give you a decent life there.

- Portugal: Similar culture, lower costs, and the Non-Habitual Resident (NHR) program can give you tax benefits for 10 years. €1,500/month goes way further than in Italy.

- Eastern Europe: Bulgaria, Romania, or even Croatia have much lower costs and they’re still in the EU.

The key thing: own your home or keep rent really low. If you can get housing down to €400-600/month, suddenly €1,200/month becomes livable.

2. Barista FIRE

This is probably the most realistic option for most people. Use your $500k to cover 70-80% of your expenses, then work part-time or freelance to cover the rest. Here’s why this works:

- Lower withdrawal rate: If you only need to take out 2-2.5% instead of 3-4%, your money lasts much longer

- Income flexibility: You can work more during good years, less during bad market years

- Mental health: Having some structure and purpose is actually good for most people

- Tax optimization: In Italy, if you keep your income low enough, you might qualify for some tax breaks

Example: If you need €1,800/month to live, take out €1,200/month from investments (2.9% of €500k after taxes) and earn €600/month from part-time work. That’s 20 hours/week at €15/hour—totally doable and you can keep doing it.

3. Coast FIRE

If you’re in your 30s or early 40s, you might have enough to “coast” to traditional retirement. The idea is: you’ve saved enough that if you stop putting money in now, your investments will grow enough to fund a normal retirement at 65-67.

The math: With €500k invested in something like VWRL, if we assume 6% real returns (which is realistic for global stocks over the long term), you’d have about €2.4M by age 65 (adjusted for inflation). That’s enough for a comfortable retirement. So you can:

- Take lower-paying but more enjoyable jobs

- Work part-time

- Take long sabbaticals

- Cover current expenses while your investments grow without touching them

You’re not fully retired, but you’re not stressed about saving anymore.

4. The Hybrid Year

Work really hard for 6-9 months, then take 3-6 months completely off. This makes your $500k last longer because:

- You’re not taking money out during work periods

- Your investments keep growing during your off periods

- You get the psychological benefit of long breaks

Example: Work full-time for 8 months, save a lot, then take 4 months off. During those 4 months, you take out maybe €1,500/month (€6,000 total). Your $500k barely moves, and you get a quarter of the year free.

5. Reduce Your Biggest Expense: Housing

Housing is usually 40-50% of people’s expenses. If you can fix this, $500k becomes much more workable:

- Own outright: If you already own a home, you’re golden. If not, think about buying a small place in a cheaper area with part of your $500k

- House hack: Buy a place with extra space, rent out rooms to cover most of your expenses

- Downsize a lot: Move from a 3-bedroom apartment to a 1-bedroom or studio

- Live with family: If you have that option and it won’t drive you crazy, it’s a huge financial win

- Van life / tiny house: If you’re adventurous, this can cut housing costs to almost zero

If you can get your total monthly expenses down to €1,200-1,500, suddenly €500k becomes possible, especially with some part-time income.

6. The “One More Year” Strategy (But Make It Two)

Instead of retiring with $500k, work two more years and aim for $750k. The difference is huge:

- At $500k: €1,125-1,500/month (after Italian taxes at 3-4% withdrawal)

- At $750k: €1,665-2,220/month (after Italian taxes at 3-4% withdrawal)

That extra €500-700/month is the difference between “I’m surviving” and “I’m actually comfortable.” Two years of saving a lot when you’re already close is totally doable.

7. Create Multiple Income Streams

Don’t rely 100% on your investments. Build 2-3 small income streams that can cover 20-30% of your expenses:

- Online freelancing: Use your skills to do remote work 10-15 hours/week

- Passive income: If you have a skill, create a digital product (course, ebook, template)

- Part-time consulting: Even 2-3 clients/month at €500-1,000 each makes a big difference

- Rental income: If you have extra space or can buy a small rental property

The goal: earn enough so you only need to take out 2-2.5% from your investments, which makes your $500k last much longer.

8. The “Enough” Mindset

This is the mental part: $500k might not be enough for your current lifestyle, but it might be enough for a simpler lifestyle that you’d actually enjoy more. Ask yourself:

- Do I really need that expensive car, or would a used one work?

- Do I need to live in the city center, or would a quieter neighborhood be better?

- Do I need all those subscriptions and services?

- What would make me happy that doesn’t cost much?

Sometimes the path to FIRE isn’t about having more money—it’s about needing less. And honestly, most people find out they’re happier with less once they make the jump.

The Bottom Line

Can you stop working with $500k? Not really, at least not in the traditional “retire forever and never work again” sense—especially if you’re Italian.

But here’s the thing: you don’t need full FIRE to have financial freedom. With $500k, you can:

- Work only when you want to

- Take long sabbaticals

- Say no to toxic jobs

- Choose projects that excite you

- Live a simpler, more intentional life

That’s “almost FIRE”—and honestly, for most people, it’s better than full FIRE because you still have some structure and purpose, but you’re completely free to walk away from anything that doesn’t serve you.

My recommendation:

- If you’re in Italy: use the strategies above to make $500k work for “almost FIRE,” or aim for $750k-1M if you want full FIRE without compromises.

- The key is combining your $500k with some income (part-time work, freelancing, etc.) to reduce your withdrawal rate and make it sustainable long-term.

The good news? You’ve already accumulated $500k, which is more than most people ever save. You’re in a position where you have options—you can walk away from toxic jobs, negotiate better terms, or take calculated risks. That’s financial freedom, even if it’s not full retirement yet.

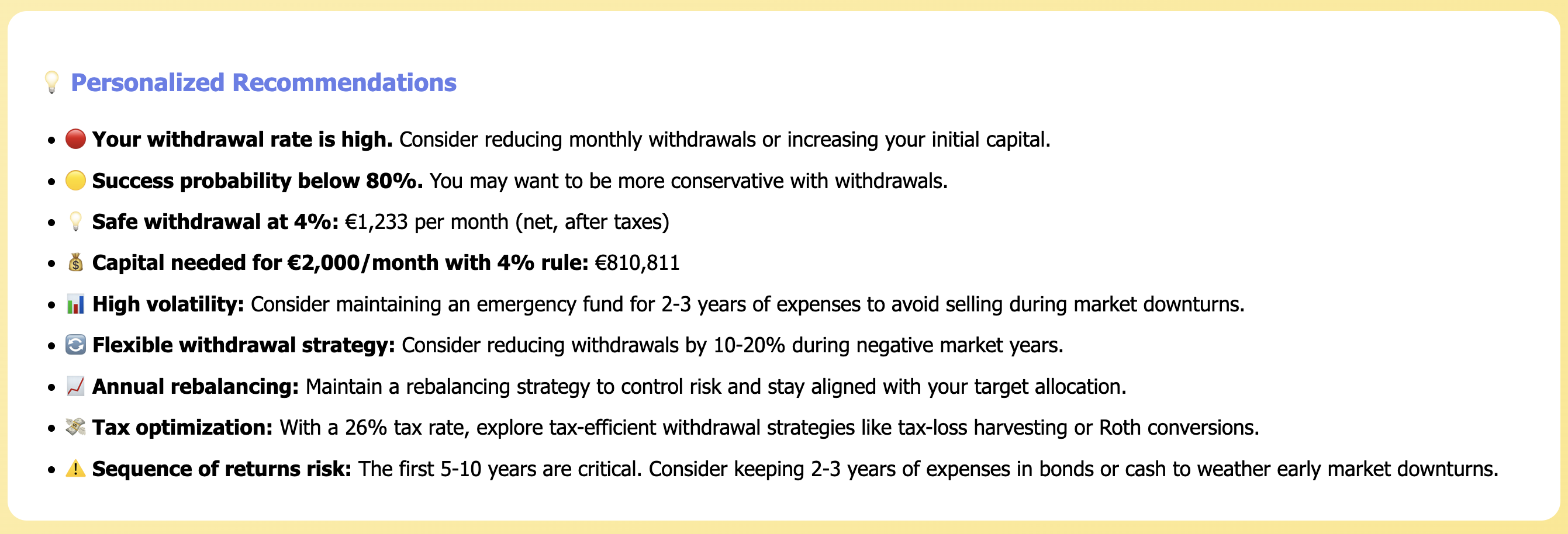

Use the FireCalc tool to model your specific scenario: plug in your country’s tax rates, your expected expenses, and see how long $500k lasts under different withdrawal strategies. Then decide if it’s enough, or if you need to push for another $200k-300k before you’re ready to pull the trigger.

Because at the end of the day, FIRE isn’t about hitting a magic number—it’s about having enough to live the life you want, not just the life you can afford.